NY & CT Foreclosure & Bankruptcy Attorneys

Schedule A Free Consultation 914.472.6202

How a New York Foreclosure Attorney May Help

Please keep in mind that this list below may be long but is definitely not exhaustive of all of the legal terms and definitions you may come across if you find yourself in a mortgage foreclosure. At CGW we have helped thousands of homeowners for decades navigate the ever-changing foreclosure process. We know the ins and outs of foreclosure defense and base our strategy on your goals and needs.

Foreclosure Terms and Definitions

Acceleration

An option given to lenders through an “acceleration” clause in the mortgage requiring the borrower to pay the entire balance of the loan all at once if their loan is in default.

Affidavit

A sworn statement in writing usually given while under oath or in the presence of a notary.

Appraisal

The process in which a licensed or authorized person gives an estimate of property value.

Appreciation

The difference between the increased value of the property and the original value.

Assignment

The transfer of property to be held in trust or to be used for the benefit of the creditors (lenders).

Bid

The offered amount for a property for sale at auction.

Cash for Keys

A type of settlement offer for borrowers in foreclosure, whereby a borrower will consent to allow the foreclosure action to proceed in exchange for a certain amount of money and definitive time left in the property. At the expiration of the time period, the borrower must vacate and leave the property in broom swept condition, in order to qualify for the agreed upon monetary amount.

Compliance Conferences

Court held conferences between the Lender and borrower, whereby discovery is exchanged. Discovery is the exchange of documents and information.

Deed

A signed document that transfers ownership of property from one party to another.

Deed-in-lieu of Foreclosure

An instance where borrowers voluntarily convey their rights in a property to the lender.

Defendant

Most Defendants in a foreclosure lawsuit are inclusive of the borrower(s), owner(s) and any other judgment creditors or liens on the subject property.

Deficiency Waiver

A judgement against a borrower for the remaining balance of their loan once their home has sold in a foreclosure sale.

Fair Market Value

The price a property would sell for on the open market.

Foreclosure Settlement Conferencing (aka 3408 Conferences)

Mandatory court conferences held pursuant to CPLR 3408, to determine whether the parties can reach a mutually agreeable resolution to help the borrower avoid losing his or her home, and evaluating the potential for a resolution in which payment schedules or amounts may be modified or other workout options may be agreed to, including, but not limited to, a loan modification, short sale, deed in lieu of foreclosure, or any other loss mitigation options; or whatever other purposes the court deems appropriate.

Free & Clear

Ownership of property free of all indebtedness.

Judgement of Foreclosure and Sale

The entry of Judgment of Foreclosure and Sale is the final motion that must be granted in a foreclosure matter before the Lender can proceed to noticing the property for a foreclosure sale.

Judicial Foreclosure

A foreclosure that is processed by a court action. In New York, all residential mortgage loans are subject to judicial foreclosure.

Lien

A charge upon real or personal property for the satisfaction of a debt (i.e., mortgage on a borrower’s property).

Legal Description

A formal description of real property sufficient to locate it by reference to government surveys or approved recorded maps.

Lender

A person who lends money for temporary use on condition of repayment with interest (i.e., the bank, mortgage company, etc.).

Lis Pendens

A recorded notice of pending lawsuit.

Loan Modification

Any change to your existing mortgage.

Motion for Summary Judgment

Pursuant to CPLR 3212, the Motion brought by either Plaintiff or Defendant aims to prove that there are no genuine issues of fact before the Court. For a Plaintiff, it must provide, among other things, copies of the subject mortgage, note and evidence of default.

Mortgage

A written pledge of property that is used as security for the repayment of a loan.

A mortgagee (i.e., lender/bank/lienholder) who is occupying the property to the exclusion of the owner.

Notary

A public officer licensed by the state to attest to and certify the validity of signatures of others. A notary is often referred to as a notary public.

Notice of Sale

A notice giving specific information about the loan in default and the proceedings about to take place. This notice must be recorded with the county where property is located and advertised as stated in the security document or as dictated by state law. In New York, the property must be noticed for four consecutive weeks prior to the sale date.

Plaintiff

The lender (i.e., bank, mortgage company, individual, etc…) who owns the note and mortgage of the subject foreclosure property.

Referee

An attorney in the area who is appointed by the Court to confirm the judgment of foreclosure and sale amount and conduct the foreclosure sale.

A type of settlement before or during the foreclosure, whereby the borrower markets the property for sale. Upon an accepted offer and executed contract of sale, the contract and short sale application are submitted to the Lender for approval. In a short sale, more is owed on the subject property to the lender then the fair market value.

Title

The instrument that is evidence of a person’s right in real property (i.e., a deed).

Attorneys Who Can Help You Defend Your Foreclosure

Please give us a call at 914.472.6202 or contact us online for a free consultation to discuss your particular needs during this difficult time.

For a commercial tenant, obtaining and keeping a lease is critical to the success of the business. Losing a commercial lease through forfeiture based on an alleged lease violation can threaten a business’s survival. To make things worse, with the eviction moratorium at an end when a landlord threatens to terminate the lease or serves a notice to cure or notice of default, the tenant may have only a matter of days to resolve the problem before facing eviction.

What is a notice to cure?

The notice to cure is the first notice to be sent which informs the commercial tenant that he or she has ten or fifteen (depending on the terms of the lease agreement) days to correct the lease violation. If the commercial tenant cures the violation, then the landlord cannot take further steps to evict the commercial tenant. But, if the commercial tenant fails to cure then the next step would be for the landlord to give the commercial tenant a notice of termination.

What is a notice to terminate?

The notice of termination alerts the commercial tenant that according to the notice to cure, the commercial tenant failed to cure the violation and the landlord now chooses to terminate the tenancy. The notice of termination will inform the commercial tenant that the tenancy has been terminated because the commercial tenant failed to cure the lease violation and the commercial tenant has a certain number of days to vacate the premises. If the commercial tenant does not move out of the space, then the landlord may begin the eviction proceedings against the commercial tenant in court.

What to do if served with a notice to cure?

Fortunately, if a commercial tenant receives a notice to cure, there is a legal remedy known as a Yellowstone injunction. A Yellowstone Injunction is a New York Supreme Court proceeding initiated by the commercial tenant when the landlord seeks to terminate the lease because of an alleged default by the commercial tenant. The Yellowstone Injunction is a type of temporary restraining order that prevents the landlord from terminating the lease during which time the commercial tenant must cure the default. Getting a Yellowstone Injunction can buy the commercial tenant some time to seek a court determination as to whether they have breached the lease, and to cure any alleged default.

How to obtain a Yellowstone Injunction

To obtain a Yellowstone injunction, a commercial tenant must demonstrate that: (1) it holds a lease; (2) the landlord served a notice to cure; (3) the commercial tenant sought the Yellowstone injunction before the expiration of the cure period; and (4) the commercial tenant has the ability and desire to cure the alleged default. New York courts are inclined to grant Yellowstone injunction applications to avoid a forfeiture of a tenant’s interest in a valuable asset – a commercial lease. Tenants are best able to take advantage of this inclination by emphasizing their “ability and desire” to cure the alleged default.

Filing the Yellowstone Injunction and tolling the cure period is crucial for a commercial tenant. A court will only approve an injunction before the notice to cure deadline passes. Once the notice to cure period has passed, and the landlord has terminated the lease, the court will not grant the injunction. Curing the default may be as straightforward as executing an estoppel certificate, or it may be as time-consuming as installing a new exhaust system. Whatever the alleged default is, getting more time to cure the default and negotiate with the landlord is vital.

Have questions about an upcoming Commercial Eviction?

If you are trying to stop an eviction, time is of the essence, and the matter of utmost importance is maintaining your business. Clair Gjertsen & Weathers PLLC has been helping people through this complex process for the last 40-years. We offer free initial consultations to see which option is the best fit for you to stop a foreclosure auction sale to keep your home. Please give us a call at 914.472.6202.

New York requires that home loan borrowers receive notice of a potential foreclosure proceedings prior to commencement. This requirement is found in RPAPL 1304 which details the specific notice that lenders must serve at least 90 days before commencement of a foreclosure action. Strict compliance with RPAPL 1304 is a condition precedent to the commencement of a foreclosure action and a lender’s failure to comply with RPAPL 1304 will result in the dismissal of a foreclosure complaint.

In order to comply with RPAPL 1304, a lender needs to prove both the contents of the notice and the service of the notice.

Service

RPAPL1304 (2) requires that the notice by sent to the borrower by registered or certified mail and also by first-class mail to the last known address of the borrower, and to the residence that is the subject of the mortgage. Plaintiff must establish service through “proof of the actual mailings, such as affidavits or mailing or domestic return receipts with attendant signatures, or proof of standard office mailing procedure designed to ensure that items are properly addressed and mailed, sworn to by someone with personal knowledge of the procedure.” JP Morgan Chase Bank, N.A. v. Williams, 94 N.Y.S. 3d 882 (2d Dept 2019).

On September 29, 2021, the Appellate Division, Second Department, held that a 90-Day notice mailed jointly to two or more borrowers, is insufficient to satisfy the requirements of RPAPL 1304. Since RPAPL 1304 requires “notice to the borrower” and not borrowers, strict reading of the statute requires notice to each borrower individually. Wells Fargo Bank, N.A. v. Yapkowitz, 59 Misc. 3d 1227

A foreclosure action will be dismissed if the lender cannot prove proper service by both first-class mail and registered or certified mail individually to each borrower.

Contents

The contents of the 90-Day Notice must strictly comply with RPAPL 1304. This includes the notice being in 14 point font, containing the proper wording, and attaching a list of at least five housing counselors. A notice is not compliance with RPAPL 1304 if it fails to include any of the requirements. Aurora Loan Services, LLC v. Weisblum, 85 A.D.3d 95 (2d Dept. 2011).On December 15, 2021, the Appellate Division, Second Department, continued to strictly interpret the separate envelope rule in Bank of America, N.A. v. Kessler. In Kessler, the Court found “that inclusion of any material in the separate envelope sent to the borrower under RPAPL 1304 that is not expressly delineated in these provisions constitutes a violation of the separate envelope requirement of RPAPL 1304(2).” Therefore, the inclusion of any notices regarding the rights of a borrower in bankruptcy or in military service violates the separate envelope rule.

Have Questions about RPAPL 1304?

Clair Gjertsen & Weathers PLLC are proven foreclosure defense attorneys and we continue to monitor this ever-changing foreclosure landscape in New York for our clients. For additional questions regarding RPAPL 1304 and the most current foreclosure laws, we invite you to contact Clair Gjertsen & Weathers PLLC by calling 914-472-6202. We look forward to hearing from you.

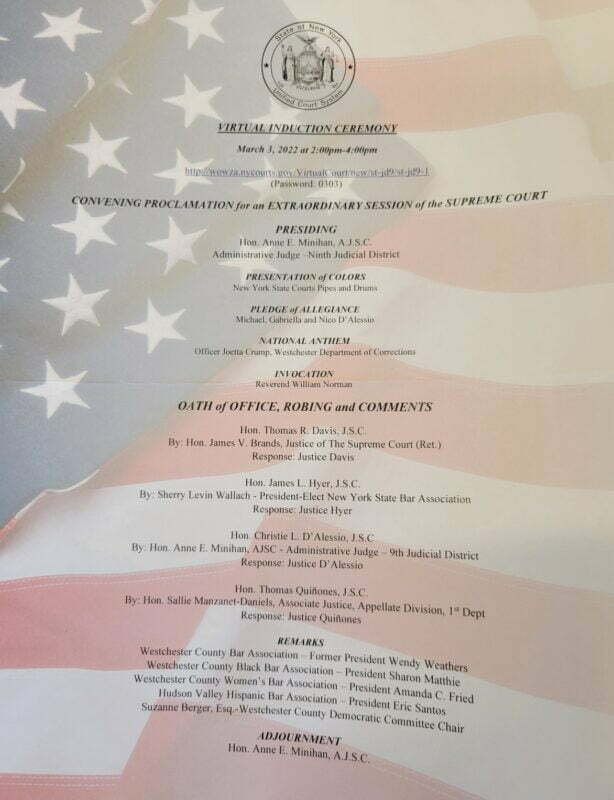

Congratulations to Hon. Thomas R. Davis, Hon. James L. Hyer, Hon. Christie L. D’Alessio, and Hon. Thomas Quinones.

Wendy Marie Weathers humbly participated in yesterday’s Ninth Judicial District Supreme Court Induction Ceremony presided by the Honorable Administrative Law Judge of the Ninth JD, Hon. Anne E. Minihan, A.J.S.C.. As the Immediate Past President of the Westchester County Bar Association, Wendy Marie Weathers to be invited to say a few words at the Ninth Judicial District Supreme Court Induction Ceremony along side her colleagues, Sharon Matthie, the Immediate Past President of the Westchester Black Bar Association, and Sherry Levin-Wallach, the President-elect of the New York Bar Association.

United States Supreme Court Justice, Oliver Wendell Holmes, Jr. stated, “The great thing in the world is not so much where we stand, as in what direction we are moving.” We are inspired and encouraged to appear before you and witness your administration of justice with the core principles of the judiciary in mind – independence, impartiality, integrity, fairness, equality, competence, and diligence. Congratulations!

Massive blow to Debt Collectors- New York passes legislation that alters how collection lawsuits are filed.

New York Governor Hochul recently signed into law Senate Bill S153 also known as the Consumer Credit Fairness Act. The Act amends the provisions of New York Civil Practice Law and Rules, also known as the CPLR, that significantly impacts debt collection lawsuits filed by creditors and third-party debt collectors.

What changes were made by the Consumer Credit Fairness Act?

The key changes made by the Consumer Credit Fairness Act include the following:

- For most debt collection lawsuits arising out of a consumer credit transaction, the statute of limitations is reduced from six years to three years.

- A payment toward the debt or “written or oral affirmation” of ownership of the debt by a consumer does not revive or extend the limitations period.

- A debt collector must attach to the complaint the contract upon which the action is based.

- The complaint must also include, among other things, the name of the original creditor, the last four digits of the account number, and the date and amount of the last payment.

- A debt collector must provide a completed “additional notice of lawsuit” to the court clerk when filing the proof of service for the complaint, which the clerk will then mail to the consumer.

- If a debt collector seeks a default judgment, it must submit supporting affidavits from the original creditor, any prior assignors or sellers of the debt, and a witness for the collector who can verify the chain of title for the debt.

- All debt collectors requesting a default judgment must also include an affidavit, stating that the statute of limitations to enforce the debt has not expired.

What benefits does the Consumer Credit Fairness Act give to debtors?

By reducing the statute of limitations for debt collection lawsuits from six years to three years, the Consumer Credit Fairness Act will significantly reduce the amount of debt involved in a lawsuit. Furthermore, the Consumer Credit Fairness Act will provide more transparency to what debt collectors are attempting to do once a lawsuit is filed how much debt collectors are allowed to take legal action for. By doing so, the Consumer Credit Fairness Act will target borderline exploitative debt collectors that attempt to circumvent the law. As stated by New York State Senator Kevin Thomas, “Abusive and exploitative debt collection lawsuits have become an epidemic across New York State. The consequences of these lawsuits—which often prey on the elderly, disabled, and low- and moderate-income New Yorkers—are devastating, especially at a time when New Yorkers are already suffering financial difficulties as a result of COVID-19. The Consumer Credit Fairness Act will stop these abusive and often illegal debt collection practices in their tracks.”

Do the changes made by Consumer Credit Fairness Act apply immediately?

Apart from the reduction of the statute of limitations from six years to three years and the prohibition on revival or extension of the statute of limitations period which becomes effective on April 6, 2022, the other changes described above become effective on May 6, 2022.

The importance of hiring an Experienced Consumer Debt Defense Attorney:

These changes along with the changes made by the New York Fair Consumer Judgment Interest Act, make it more important than ever to speak with an attorney that is experienced with consumer debt defense. Clair Gjertsen & Weathers PLLC is an experienced Consumer Debt Defense law firm in New York . We negotiate with debt collection law firms and remove holds on your bank accounts or wages garnishments.

For additional questions regarding the consumer debt defense process, we invite you to contact Clair Gjertsen & Weathers PLLC by calling 914-472-6202. We look forward to hearing from you.

The New York State Legislature is currently reviewing Bill S5473D that relates to the rights of parties involved in foreclosure actions and provides additional details regarding the commencement and termination of certain actions related to real property. The title of this Bill is the Foreclosure Abuse Prevention Act.

What is the Purpose of the Foreclosure Abuse Prevention Act?

The Purpose and Intent of the Bill is to address the ongoing problem with abuses of the judicial foreclosure process in New York and lenders’ attempts to manipulate statutes of limitations, which problem has been worsened by recent court decisions which, contrary to the intent of the legislature, have given mortgage lenders and loan servicers opportunities to avoid strict compliance with remedial statutes and manipulate statutes of limitation to their advantage.

Specifically, there is a recent decision of the Appellate Division in Citi Mortgage, Inc. v. Ramirez, 192 AD3d 70 (2020), which effectively gives mortgagees a second bite of the mortgage apple, permitting actions to be instituted on a note after a foreclosure action based on the same debt has already been adjudicated to be barred by the statute of limitations.

Furthermore, the bill seeks to amend CPLR Sec. 3217 as it concerns the discontinuance of mortgage foreclosure actions and is a direct response to the Court of Appeals recent holding Freedom Mtge. Corp. v Enge1, 37 NY3d 1 (2021).

What is the Statute of Limitations for bringing a foreclosure action?

New York law has a six-year statute of limitations concerning contracts. See NY CPLR § 213. Because a mortgage is a contract, this limit applies to mortgage foreclosure as well, with each payment becoming its own cause of action, time-barred six years after its due date.

How will this bill help New York homeowners in foreclosure defense?

As a direct result of these judicial decisions, thousands of New York homeowners who secured closure of their cases by operation of longstanding statute of limitations principles are at risk of an onslaught of successive foreclosure actions that would otherwise be barred by the statute of limitations under longstanding statutory and case law. This will cause the loss of countless homes and will burden the Courts with cases that should be barred by the statute of limitations and with excessive motion practice now that the foreclosure moratoriums have ended. This bill levels the fields for all homeowners and ensures the statute of limitation applies to all parties equally without exemption

There are several defenses to foreclosure. Most of the defenses are related to the lender making a mistake. Some examples of foreclosure defenses are lender’s noncompliance to RPAPL Article 13, lack of standing, improper affidavits and statute of limitations.

Does this Bill Apply to all Foreclosure Actions?

The legislature is seeking to apply this bill to all actions governed by CPLR 213 (4) in which a final judgment of foreclosure and sale has not yet been enforced.

Have Questions About Foreclosure Defense?

Clair Gjertsen & Weathers PLLC are proven foreclosure defense attorneys and we continue to monitor this ever-changing foreclosure landscape in New York for our clients. For additional questions regarding the implications of these decisions and the most current foreclosure laws, we invite you to contact Clair Gjertsen & Weathers PLLC by calling 914-472-6202. We look forward to hearing from you.